Member News – October 4, 2022

40th Annual Covered Bridge Festival Starts Tomorrow!

Festivities begin at the Bloomsburg Fairgrounds Thursday October 6 and run through October 9. The festival is one of the largest craft festivals on the east coast. Read more.

11th Annual Berwick Riverfest Set for October 7-9

Held at the Test Track Park, the event has free admission, parking concerns, and celebrates the Borough of Berwick. Read more.

Barry Isett & Associates Appoints New Positions to Support Company Growth

Congratulations to Brandon Trate, PG, Chris Kotch, PG, and Erin Burke, who have been appointed to the positions of Vice President of the Lehigh Region, Vice President of the Field Division, and Vice President of the Southeast Pennsylvania Region, respectively. Since its founding in 1977, the company has expanded to nine offices and more than 250 associates. Read the full release here.

Encina to Host Point Township Circular Manufacturing Facility Update Meeting

Join Dave Roesser, CEO, and Michael Marr, Director of Government Relations and Compliance for a project update meeting on October 11, at 2pm at the DRIVE Professional Building, 418 Railroad St. Suite 101, Danville. Click here for background on the project. RSVP to the meeting here.

Columbia Montour Quarterly Hits Digital Shelves

Check out the latest edition of the Visitor’s Bureau’s quarterly digital magazine. Check it out.

SITEexchange Has Hit the Streets

Exchange has delivered 27 vending machines to venues across the region, containing capsule-copies of 49 artsworks. Be on the lookout for the machines, and originals are on display through October 10. Read more.

Community Strategies Group to Host Art Show at Bill’s House, October 6

Celebrate local muralist Diane Derr’s return to art at The Sanctuary Art Gallery at Bill’s House in Bloomsburg. Light refreshments available, event from 6pm – 8pm.

McKonly & Asbury Named One of Best Places to Work in PA for 18th Time

The regional accounting and business advisory services firm has announced that they have been chosen as one of the Best Places to Work in PA for 2022. This marks the 18th time in 20 years that McKonly & Asbury has been recognized for this honor. Read the full release.

CareerLink Job Fair Tomorrow, October 6

Local employeers will be on site at the Bloomsburg YMCA from 1pm – 4pm.

October is Spina Bifida Awareness Month

Camp Victory is celebrating the campers and families of Camp Spifida and the Camp Spifida Retreat this month.

Bloomsburg Area YMCA to Host Trunk or Treat October 28th

Bloomsburg Area YMCA is asking for participants to decorate their trunks and provide treats to hand out. To sign up, email Serena, Youth Development & Family Engagement Director, at shampton@bloomsburgy.org or call the YMCA’s front desk at (570)784-0188.

Geisinger Promotes ZING, a Free Wellness Resource

Learn more about the program that’s helping community members get advice and reminders for healthy living.

Bloomsburg Theatre Ensemble’s ‘A Christmas Carol’ to Feature Students

Eleven special school matinees for ‘A Christmas Carol’ are scheduled for November 29, 30, December 1, 6, 7, 8,13, 14, 15, 20, and 21.

Invitation to Bid Packages Available for MARC 2023 Lawn Care and Montour Preserve Snow Removal

Invitation to bid packets for both contracts are now posted to MARC's website have been posted to the MARC website and Montour Preserve Facebook pages, and will be advertised in local newspapers in the coming days. Read more.

PA Celebrates Manufacturing Week

Source: DCED

The Pennsylvania Department of Community & Economic Development (DCED) is excited to celebrate Pennsylvania Manufacturing Week on October 7-14, 2022.

The Pennsylvania Department of Community & Economic Development (DCED) is excited to celebrate Pennsylvania Manufacturing Week on October 7-14, 2022.

Governor Tom Wolf has proclaimed the week as Manufacturing Week in Pennsylvania to honor our manufacturing industry, our makers, and encourage the next generation of talent to take a closer look at manufacturing careers in the commonwealth.

Today’s industry demands experienced problem-solvers and strategists, digital operators, engineers, and others who can blend management and STEM skills. And we’re proud that our state is preparing the next generation of talent for careers in manufacturing. We know these careers offer challenging, fulfilling, and stable work — presenting us with the opportunity to bring Pennsylvania’s innovation, imagination, and legendary can-do spirit to the industry at the heart of our economy and communities.

Manufacturing is at the heart of Pennsylvania’s economy.

(bea.gov Employment by State 2020; Pennsylvania Manufacturing Advisory Council, PA’s Manufacturing Competitiveness Playbook 2022)

- 6th largest manufacturing industry in the United States by employment

- $113.2 billion in gross domestic product (GDP) in 2021

- 562,700+ employees (accounting for ~9.5% of all privatesector jobs in PA)

- 14,000+ manufacturing establishments

Manufacturing offers well-paying, family-sustaining jobs.

(Pennsylvania Manufacturing Advisory Council, PA’s Manufacturing Competitiveness Playbook 2022)

- Manufacturing workers earn 33% more compared to the average for other nonfarm businesses in the state

- $86,129 avg. compensation in manufacturing in PA, including benefits

U.S. manufacturing jobs have great employee benefits.

(Pennsylvania Manufacturing Advisory Council, PA’s Manufacturing Competitiveness Playbook 2022; U.S. Chamber of Commerce)

- Many manufacturers offer on-the-job training that helps employees expand their skillsets and adapt to new industry needs

- 90% of U.S. manufacturing employees have access to medical benefits through their employer

- 78% of U.S. manufacturing employees have access to retirement benefits from their employer

- U.S. manufacturing workers have the highest job security in the private sector.

Manufacturers and makers come from diverse backgrounds and have a variety of skills and education levels.

(bls.gov, Manufacturing Career Outlook, From Prototype to Production: Careers that Bring Ideas into Being, 2018)

- Entry-level positions have different educational requirements ranging from a high-school diploma (or equivalent), to a bachelor’s degree or higher.

- Many manufacturing positions include apprenticeship opportunities and on-the-job training – offering an opportunity to earn income while learning new skills

- Career opportunities abound for those looking for work in the manufacturing industry including:

- Industrial designers

- Mechanical and electrical engineers

- Graphic designers

- Systems software developers

- Team assemblers

- Electricians

- Computer-controlled machine tool operators (metal and plastic)

- Industrial machinery mechanics

2022 Partner Toolkit

Help us spread the word about modern manufacturing, its positive impact on our economy and communities, and how it benefits existing employees and students who are exploring career options. DCED's digital toolkit will help you get started with suggested social media posts, newsletter content, and digital graphics. Get involved and be sure to share your own manufacturing resources and stories. Chamber members, if you use the toolkit, be sure to tag the Columbia Montour Chamber in social media so that we can share your posts all week. Download the toolkit here.

Local Resources

To connect with local manufacturing resources, consider contacting your Chamber to learn more about the Manufacturer's Council, as well as Chamber members Northeastern PA Industrial Resource Center (NEPIRC) (Columbia County), and Innovative Manufacturers Center (IMC) (Montour County). You can also check out information about the Columbia Montour Chamber Foundation 's programs such as "What's So Cool About Manufacturing." For a list of local manufacturers, check out our directory!

Addressing the Shift in Workplace Dynamics…Change is Good

Source: My Benefit Advisor

It’s quite evident that the past few years have seen drastic shifts in the country’s workplace environment. For many people, changes in the workplace can create stress and discomfort as they are required to vacate the norms and practices long held to attempt new ways of working and interacting with fellow employees and company leaders.

Change is Good

But change is good, and in fact, it is essential to virtually all aspects of business life. And in fact, change has been a reality in the business world since well before the modern workplace was established. The pandemic simply accelerated the rate of change. Typically, companies that modify their practices to adapt to change open the doors to creative opportunities and often thrive. The ability to recognize the need to change and face the challenges head-on will not only benefit the company itself but also the individuals who comprise the workforce.

Businesses that fail to adapt to these changes can often stagnate or even fail. The stale environment they foster stifles creativity and the birth of new and forward-thinking ideas. And many times, it’s these new ideas that lead to better opportunities for overall success through more efficient operations, fresh new product or unique, cutting-edge services.

Forces Impacting a Company’s Need for Change

For a variety of reasons, today’s workforce has taken on a look different and very unique from that of the past. Business owners, aware of these shifts and the dynamic changes between employer/employee relationships, have taken notice and are reshaping their workplace practices and benefit portfolios to avoid any potential turnover in their workforce.

The new look of today’s workplace is due to a variety of factors, each of which may impact individual companies to various degrees. Here are a few forces that may work to pressure company leadership to consider changes to established practices:

- Employee Demographics… For possibly the first time in history, there can be five different generations in the workplace. Each age group comes with a unique perspective on their work responsibilities and have life-style specific needs and interests. For employers, understanding this multigenerational dynamic and its implications is essential for driving innovation and maintaining cohesive and productive work groups.

- Changes in Workplace Structure… The pandemic changed the traditional model of work in an office environment. Today, most people work remotely and although many firms have tried luring workers back to the office, for the most part, they’ve had limited success. Hybrid work models are likely the norm going forward but will pressure the company’s employee culture, engagement and productivity methods and levels.

- Changing Focus on Diversity, Inclusion and Equity… The employee population of today has seen shifts in gender roles and includes an ever-widening range of racial groups and ethnic backgrounds. Many of these groups, notably including women, are commanding a greater sphere of influence and power. And these same employees are demanding new approaches to work culture, looking for employers to recognize their personal needs and value, both in the workplace and in their home life. As a result, employers are offering more competitive pay, enhanced health benefits and flexible work-from-home arrangements. But more than just competitive pay, employees have demanded racial, gender and pay equity. Employers have recognized that creating an inclusive culture is important to the success of their company and its long-term growth and profitability, since today’s employees are quick to begin searching for new employment if they feel their needs are not being met.

- Changes in Government… Whether on a local or national level, changes in government invariably involves a shift in political agenda, which often times impacts how businesses operate. In obvious terms this can refer to compliance issues, but employers need to also look carefully for indirect and more subtle impacts as well.

In short, employers should view change as good. Today’s workplace demands constant attention to changing dynamics, but the reward for adaptation to needed changes often means the difference between success and failure.

The Columbia-Montour Chamber of Commerce offers its members access to My Benefit Advisor as a solution for employee benefits, including voluntary offerings. For more information about My Benefit Advisor, visit our website at cmcc.mybenefitadvisor.com or contact Stephen Lylo at (917) 692-8192.

Columbia County Dealing With Urgent Issues

Columbia County is dealing with increasing substance use and behavioral health issues among residents and addressing long-term flooding risks to communities while managing costs for businesses and property-owners. The Commissioners have also invested COVID relief funds into workforce programs to support employers with critical workforce needs. Commissioner Rich Ridgway discussed these efforts with the Chamber’s Board of Directors in September.

Columbia County is dealing with increasing substance use and behavioral health issues among residents and addressing long-term flooding risks to communities while managing costs for businesses and property-owners. The Commissioners have also invested COVID relief funds into workforce programs to support employers with critical workforce needs. Commissioner Rich Ridgway discussed these efforts with the Chamber’s Board of Directors in September.

Ridgway estimates that 50% to 70% of the inmates in the county jail are related to drugs or behavioral health issues. In many cases, there are no options to send people for treatment. The jail, adult probation, and children and youth services account for approximately half of the county’s $32 million budget. State funding and revenue from housing inmates from other counties help offset these costs.

The Commissioner noted that Columbia County has the lowest tax rate of any sixth-class county in the state, and he expected no tax increase next year.

Recognizing that workforce is a critical issue for employers in the county, the Commissioners invested COVID relief funds to create programs. The Skilled Trades Training Program offers free courses to residents of Columbia County or employees of County businesses at Columbia-Montour Area Vo-Tech and Central Columbia High School. Those that complete at least five of the courses receive a Maintenance Mechanic Certificate. Program details are available at cmvt.us.

The Chamber’s Foundation was awarded funding to create Skills That Pay. The five-module program, also offered through Columbia-Montour Vo-Tech, helps people develop foundational job skills including interviewing, teamwork, and basic financial literacy. Those that complete the free program also receive a certificate and are guaranteed interviews with county employers. Information about the Skills That Pay program is under the Foundation tab of the Chamber’s website, columbiamontourchamber.com. The Chamber and its Foundation are working with the County’s adult probation department and human service agencies to try to mobilize people back into the workforce through this program. Chamber Board members expressed interest in working with lower-level offenders and people in recovery on work-release.

The Commissioners also continue to pursue flood protection and mitigation throughout the County. Through the efforts of Senator John Gordner and Representative David Millard, $1.3 million was received for flooding and stormwater management issues. A significant portion of those funds has been distributed to local municipalities. Specific projects include bridge improvements in Millville, floodproofing in Benton, and the Fishing Creek Watershed and Bloomsburg West End flood mitigation studies. A stormwater management plan has also been developed for the Rt. 11 corridor including South Centre Township, Scott Township, and the Town of Bloomsburg, following isolated flooding that impacted a number of businesses and residents in 2018. The Chamber organized the initial meetings following that flooding. Several projects to reduce risks along the corridor have been completed.

Commissioner Ridgway thanked the Chamber Board for the opportunity to discuss these issues and welcomed additional opportunities to work with County employers.

###

October is Local Chamber of Commerce Month

Source: Office of the Governor of Pennsylvania

Pandemic with a Pandemic

Source: Pennsylvania Restaurant and Lodging Association News

Drug and alcohol abuse soars with COVID-19

The pandemic led to mass layoffs, isolation, and poor mental health. It became a perfect environment for drug and alcohol abuse. Americans turned to drugs and alcohol in shocking numbers, consider the following findings:

- Drug overdose deaths topped 100,000 last year for the first time ever, with record overdose deaths each of the past two years, according to the CDC.

- Mortality rates from alcohol use disorder were 25% higher than projected in 2020 and 22% higher in 2021, according to a study by researchers at Cedars-Sinai.

- Canadian researchers found alcohol abuse among those who used before the pandemic increased 26%, while drug use increased 16%.

The nation's restaurants have long been havens for drinking and drug use. But the influx of dangerous new drugs like fentanyl, coupled with the stress from the pandemic and its impact, have made matters far more deadly. Restaurants now face an evolving epidemic of addiction.

The Pa. Department of Drug & Alcohol Programs offers support services and resources to help people with substance use disorder, including Just Five — a free online workforce education tool — and the Get Help Now Hotline — a confidential hotline (1-800-662-4357) staffed by trained professionals 24/7/365.In addition to the many communities offering free training, the state has two approved online training courses regarding administering naloxone.

THESE FIVE FACTS SHOW HOW BADLY INFLATION IS HURTING SMALL BUSINESS

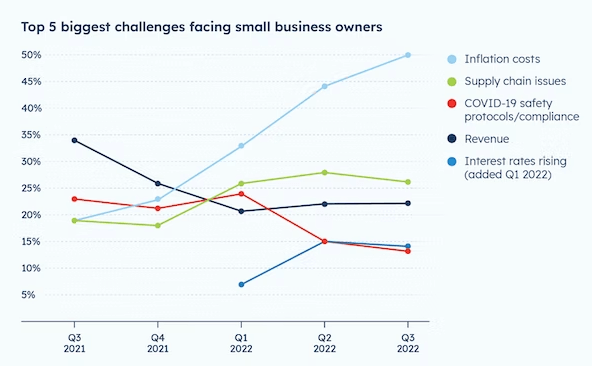

This quarter, the MetLife and U.S. Chamber Small Business Index found that small businesses’ concern about inflation has reached the highest level since Q3 of last year. Here are five data points from this quarter’s report that show how inflation is hurting small business owners.

1. Inflation is the top challenge facing the small business community

Half (50%) of small businesses now say inflation is the top challenge facing the small business community. This marks the fifth consecutive quarter of increasing concern over inflation and represents a dramatic 31-point increase since this time last year (when only 19% said inflation was a top challenge).

Inflation is the top concern for small businesses regardless of their location, number of employees, or sector.

2. Most believe inflation will get worse

According to the report, most small businesses anticipate inflation will get worse. Seven in ten (71%) believe the worst is still to come with regards to inflation.Karen Olson Beenken, president and CEO of Blue Rock Companies, in Sidney, Montana, says she finds inflation everywhere she turns.

“Payroll is up because we have to pay more to retain and attract employees,” Beenken says. “The cost of fuel is up. The cost of freight is up significantly—and it’s gotten more and more difficult for us to get freight companies to come to our rural markets as frequently as they used to. Our health insurance was up this year. Those are all big cost inputs, and they are all up significantly. These are very challenging times for our business.”

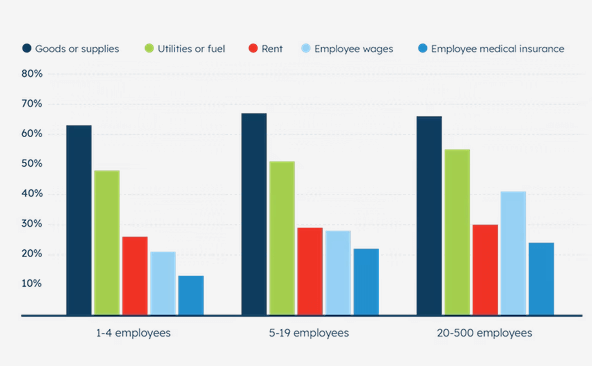

3. Higher costs for goods/supplies hurting the most

The cost of goods and fuel/utility bills are where small businesses most often report feeling inflation. Among small business owners that say rising prices have had a significant impact on their business (83% of respondents), most cite the cost of goods and supplies (65%) and utilities or fuel (50%) as where they have seen the most impact.

4. Small businesses forced to raise their prices

To keep up with inflation, many small businesses report having to raise the prices they charge customers.

“Our suppliers have passed on expenses to us, and we held on as long as we could before passing them along to our clients,” says Julianne Weiner, COO of Sonic Promos in Gaithersburg, Maryland. “Logistics [shipping and fulfillment] seem to be absorbing the worst. Though with gas prices back in the more normal range, maybe that will decrease a bit, too.”

To cope with inflation, 7 in 10 small businesses report raising prices in response to inflationary pressures, followed by those who say they have taken out a loan (40%), reduced staff (37%), or reduced the quality of their products or services (31%).

Tom Richter, principal owner of JAN-PRO of Utah based in Midvale, Utah says he’s also had to raise prices.

“Inflation has impacted our business in many ways,” Richter says. “Gas increases have required us to increase prices across the board to customers. Raw material increases have impacted chemicals and equipment used in our business. Our franchise owners have had to increase their wages to their employees doing the daily work.”

5. Most say combatting inflation should be top policy priority

When asked to choose, more small businesses said fighting inflation should be the priority over avoiding another economic downturn.

Over half (59%) of small businesses believe the priority right now should be reducing inflation and 41% would prioritize avoiding an economic downturn.

However, interest rate hikes aren’t a negligible concern. Forty percent of small businesses say they are very concerned about the impact of interest rates rising on their business (up 11 percentage points from Q1 2022).

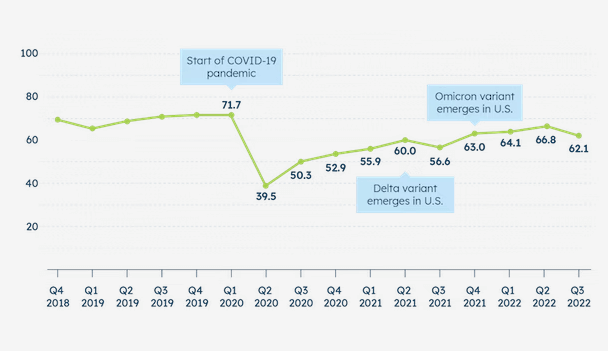

The big picture

Amid concern around inflation, the Small Business Index score dropped this quarter to 62.1, down from 66.8 last quarter. This is the largest drop in the Index since the start of the pandemic and the drop comes from small businesses saying they are now less confident in both the national economy and their current cash flow.

The Q3 2022 survey was conducted between July 21 - August 8, 2022. For more findings from this quarter,and to explore and browse years of small business data, see our full SBI Index.

About the author:

Thaddeus Swanek

Senior Writer and Editor, Strategic Communications, U.S. Chamber of Commerce

Member News – September 28, 2022

Press Enterprise Announces 2022 Fair Food Favorites Contest

Wild for Salmon Shares Fair-Style Salmon Mac & Cheese Recipe

Inspired by their trips to the Bloomsburg Fair, you're going to want to put this in your recipe book.

The Bloomsburg Public Library Strategic Planning Survey

The library needs your help completing a strategic planning survey.

Bloomsburg River Trail’s New Construction Plan

The Bloomsburg River Trail will connect Bloomsburg via dedicated pedestrian and bike paths, which will improve residents' access and usability of town assets. See the plan.

Cybersecurity: What the Nonprofit Executive Needs to Know

On September 29, McKonly & Asbury will discuss ways to mitigate and reduce risk specific to nonprofits susceptible to cyber-attack. Register here.

Empowering Educators Grant Applications Due Sept. 30

Offered by the PPL Foundation, these grants are designed to support and encourage teachers in providing hands-on learning experiences in the areas of STEM (Science, Technology, Engineering, and Math.). Read more here.

First Commonwealth Bank Named Top Workplace

Congratulations to the First Commonwealth Bank, so honored by the Pittsburgh Post-Gazette. Read More.

We Know Them! Congratulations to The Duane Family!

Chamber Ambassador Lauren Duane and family with Ben

Congratulations to Chamber Ambassador Lauren Duane (and family), who recently connected with Chamber member Cats in Bloom!

Design Group Welcomes New Hire

Joseph, Design Group's Newest Hire!

Congratulations to Design Group, who this week welcomed Joseph as the the new Manufacturing and Distribution Director in their Berwick Main Plant.

Bucknell, Wilkes Universities' Small Business Development Centers Offer Fall Programs

As the SBDC serving Montour County, Bucknell’s free educational workshops in October feature marketing & story telling, leadership, and work culture programs. Check them out here. As the SBDC serving Columbia County, Wilkes University is offering “The First Step Express”, a webinar to maximize the success rate of new businesses and entrepreneurs. Sign up here.

B.I.D.A. To Celebrate 60 Years

Highlighting its history, B.I.D.A (formed in 1962) will be working with the Press Enterprise to publish a special edition publication later this year. Congrats on your anniversary!

PA State Representative Offers Farewell Remarks

Representative David Millard, who will retire at the end of this legislative session, shared a farewell speech in the House chamber late last week. See his remarks here. On behalf of the Chamber, thank you, Representative Millard, for your service to the community.

Lockwood and Wakeman to Moderate Panels at Statewide Economic Development Conference

Congratulations to Jennifer Wakeman of DRIVE, who was selected to moderate “Rural Economic Development: Key Issues and Strategies”, and to Betsy Lockwood of SEDA-COG, who will moderate “Unpacking the Infrastructure Investment & Jobs Act”, discussing opportunities for Pennsylvania’s communities. Both will address the Fall Conference of the Pennsylvania Economic Development Association on October 25.

Kawneer Welcomes New President

Laurent Salah, Arconic BCS President

Congratulations to Laurent Salah, newly named President of Arconic Building & Construction Systems (BCS), the global manufacturer of building facade products that includes the Kawneer business. Read more.

Welcome New Member – Troop 47 Trading Company

An artisan boutique specializing in hand-poured, clean-burning candles, specialty gifts, and everyday essentials, Troop 47 Trading Company is named in honor of the Scouting and leadership legacy of owner Annie McCarty's dad, Jim. Products with the Troop 47 Trading Co. brand are handmade with the highest quality ingredients by Annie herself, and the store also features products sourced hyper-locally from crafters, artisans and makers. Welcome to the Chamber, Annie!

To learn more about Troop 47 Trading Company, visit their website, https://troop47.co.